What Is CRYPTO Currency

What is Crypto Currency Basics: Understanding the Fundamental Positively

Cryptocurrency has emerged as a revolutionary concept in the realm of finance and technology. Born out of the desire for decentralized, digital currencies, cryptocurrencies have challenged traditional notions of money and transactions. In this blog, we will explore the fundamental aspects of cryptocurrency, including its origins, underlying technology, benefits, challenges, and its future outlook.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks based on blockchain technology. This decentralized nature means that cryptocurrencies are not controlled by any central authority like a government or financial institution.

History and Origins

The concept of cryptocurrency dates back to the late 20th century, but it wasn’t until 2008 when Bitcoin, the first decentralized cryptocurrency, was introduced by an anonymous person or group known as Satoshi Nakamoto. Bitcoin aimed to create a peer-to-peer electronic cash system that operated independently of central authorities, using blockchain as its underlying technology.

Blockchain Technology

Blockchain is the underlying technology that powers most cryptocurrencies. It is a distributed ledger that records all transactions across a network of computers (nodes). Each transaction is stored in a “block” and linked together in chronological order, forming a chain of blocks (hence the name blockchain). This decentralized and transparent ledger ensures security, transparency, and immutability of transactions without the need for a central authority.

Key Characteristics of Cryptocurrencies

- Decentralization: Cryptocurrencies operate on decentralized networks, meaning no single entity has control over the entire network.

- Security: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units.

- Anonymity: While transactions are recorded on the blockchain, cryptocurrency addresses do not necessarily have to be linked to real-world identities, offering a degree of privacy.

- Limited Supply: Many cryptocurrencies have a finite supply, meaning there is a maximum number of coins that can ever be created, which contrasts with fiat currencies that can be printed indefinitely.

Popular Cryptocurrencies

Bitcoin remains the most well-known and valuable cryptocurrency, but thousands of other cryptocurrencies, often referred to as altcoins, exist. Some of the notable ones include Ethereum (known for its smart contract capabilities), Ripple (designed for fast and low-cost international payments), Litecoin (often regarded as the silver to Bitcoin’s gold), and many others catering to various niches and functionalities.

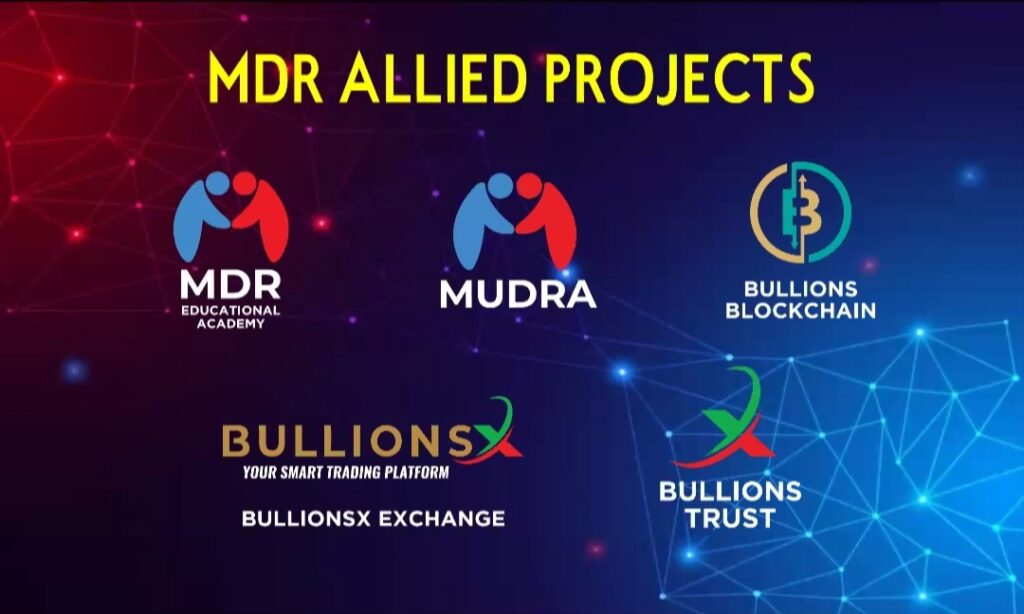

MDR (MUDRA Coin) is knowing as a internationally highly growing Cryptocurrency. MDR Coin has it’s own BULLIONS Blockchain , own BULLIONSX Crypto Exchange , own MDR gaming platform, Own MDR Educational Academy , MDR Bill payment portal and many more.

Uses and Applications

Cryptocurrencies have several use cases beyond being a medium of exchange:

- Investment: Many people buy and hold cryptocurrencies as investments, hoping their value will increase over time.

- Remittances: Cryptocurrencies can facilitate faster and cheaper cross-border transactions compared to traditional banking systems.

- Smart Contracts: Platforms like Ethereum enable the creation of smart contracts, which are self-executing contracts with the terms directly written into code.

Benefits of Cryptocurrencies

- Decentralization: Reduces dependence on central authorities and intermediaries, potentially increasing financial inclusivity.

- Security: Cryptography and blockchain technology enhance the security and transparency of transactions.

- Accessibility: Anyone with internet access can participate in cryptocurrency transactions, promoting financial inclusion.

- Innovation: Cryptocurrencies foster innovation in financial services, particularly through blockchain technology and decentralized applications (dApps).

Challenges and Risks

- Volatility: Cryptocurrency prices can be highly volatile, leading to concerns about stability and reliability as a store of value.

- Regulatory Uncertainty: Governments and regulators worldwide are still grappling with how to regulate cryptocurrencies, which can impact their adoption and use.

- Security Concerns: While blockchain itself is secure, the surrounding ecosystem (exchanges, wallets) can be vulnerable to hacking and fraud.

- Adoption Barriers: Cryptocurrencies face challenges in gaining widespread acceptance and understanding among the general public and institutions.

The Future of Cryptocurrency

The future of cryptocurrency is a topic of intense debate and speculation. Some believe cryptocurrencies will revolutionize finance and become mainstream, while others are skeptical about their long-term viability and impact. Factors such as regulatory developments, technological advancements, and market dynamics will play crucial roles in shaping the future landscape of cryptocurrencies.

Conclusion

Cryptocurrency represents a significant innovation in the world of finance and technology, offering new possibilities for decentralized transactions and digital assets. While still in its relatively early stages, cryptocurrencies continue to evolve, attracting interest from investors, technologists, and policymakers alike. Understanding the basics of cryptocurrency, including its technology, benefits, challenges, and potential future developments, is essential for anyone looking to navigate this rapidly changing landscape.

In summary, cryptocurrency is not just a new form of digital money but a transformative force that has the potential to reshape how we think about and conduct financial transactions in the future.